Key Takeaway: Mastering time management isn’t just about productivity—it’s a powerful tool for financial growth. By implementing these four proven strategies, you’ll not only reclaim valuable hours but also significantly reduce costs and boost your earning potential.

Table of Contents

Time is money—we’ve all heard this phrase, but few of us truly understand just how literal it is. As someone who spent years struggling with time management while watching my bank account suffer, I’ve discovered that the right time management strategies don’t just make you more productive—they make you wealthier.

1. The Power of Time Blocking: Your Path to Focused Productivity

Remember that feeling of starting your workday with grand plans, only to end up lost in a maze of social media notifications and “urgent” emails? I’ve been there. Time blocking changed everything for me, and here’s why it will for you too.

How Time Blocking Saves You Money

- Reduced multitasking costs: Research shows that multitasking can reduce productivity by up to 40%. That’s like throwing away $400 for every $1,000 worth of your time.

- Lower stress-related expenses: By organizing your day into focused blocks, you’ll experience less stress, potentially reducing health-related costs. According to a recent study by the American Institute of Stress, job stress costs U.S. industries over $300 billion annually.

- Improved decision-making: When you’re not constantly switching tasks, you make better financial decisions. No more impulse purchases during work breaks!

Implementing Time Blocking Effectively

- Start by dividing your day into 30-minute or 1-hour blocks

- Assign specific tasks to each block

- Include buffer time for unexpected interruptions

- Set aside dedicated blocks for financial planning and budget review

If you’re struggling with stress management while implementing these changes, check out our guide on 10 Budget-Friendly Self-Care Practices for Stress Relief You Can Start Today.

Benefits of Time Blocking

- Enhanced Focus: By dedicating specific time slots to tasks, you can eliminate distractions and concentrate fully on the task at hand.

- Improved Time Management: Time blocking helps you visualize how your day will unfold, allowing you to allocate time more effectively and avoid overcommitting.

- Reduced Procrastination: With a clear schedule in place, it becomes easier to start tasks, as you have already set aside time for them.

- Increased Accountability: Having a structured plan encourages you to stick to your commitments and take ownership of your time.

- Better Work-Life Balance: By scheduling personal time alongside work tasks, you can ensure that you dedicate time to both professional and personal activities.

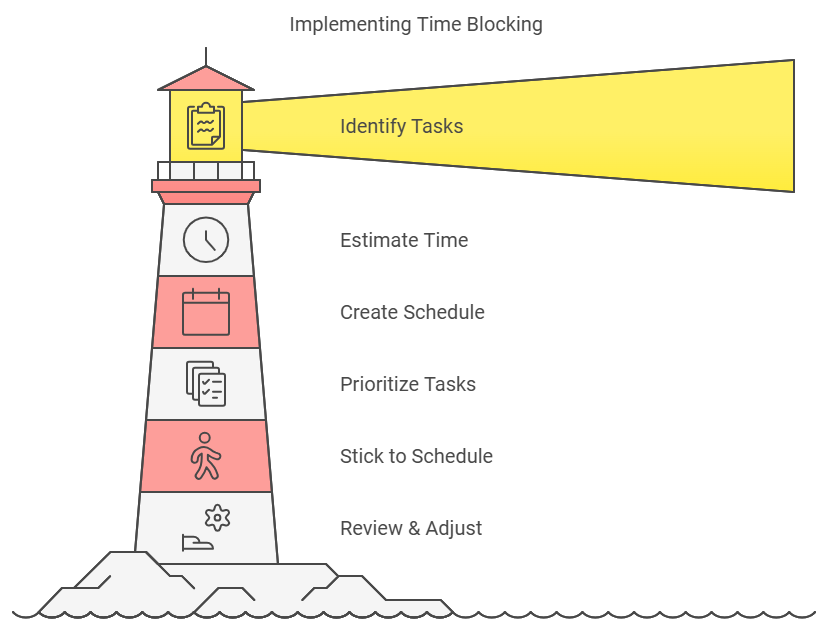

How to Implement Time Blocking

- Identify Your Tasks: Begin by listing all the tasks you need to accomplish, both work-related and personal.

- Estimate Time Requirements: For each task, estimate how long it will take to complete. Be realistic in your assessments to avoid overloading your schedule.

- Create a Schedule: Use a digital calendar or a planner to block out time for each task. Make sure to include breaks and buffer time between tasks to accommodate any overruns.

- Prioritize Your Tasks: Determine which tasks are most important and allocate time for them accordingly. Consider using techniques like the Eisenhower Matrix to prioritize effectively.

- Stick to Your Schedule: Once your time blocks are set, commit to following them as closely as possible. Treat these blocks as appointments that cannot be missed.

- Review and Adjust: At the end of each week, review your time blocks to see what worked and what didn’t. Adjust your approach as necessary to improve your productivity.

2. The Two-Minute Rule: Small Actions, Big Savings

The two-minute rule is deceptively simple: if a task takes less than two minutes, do it immediately. But here’s what nobody tells you—this rule is a secret weapon for financial success.

Financial Benefits of the Two-Minute Rule

- Prevented late fees: Paying bills immediately when they arrive

- Reduced forgotten subscription costs: Canceling unused services right away

- Better investment opportunities: Acting quickly on time-sensitive financial decisions

Want to maximize these financial benefits? Learn more about making smart money moves in our article on 7 Investments Every Beginner Should Consider Without Breaking the Bank.

3. Strategic Automation: Investing Time to Create Wealth

I used to spend hours on repetitive tasks until I discovered the magic of automation. Here’s how to turn automation into a money-making machine:

Money-Saving Automation Strategies

| Task Type | Automation Tool | Potential Monthly Savings |

| Bill Payments | Banking Apps | $35 (late fees) |

| Email Management | Filters & Rules | $200 (time value) |

| Meal Planning | Planning Apps | $150 (food waste) |

| Budget Tracking | Financial Apps | $300 (overspending) |

For more insights on financial automation, check out 5 Steps to Creating a Budget That Helps You Save More.

4. The Energy Management Revolution

Here’s a truth bomb: traditional time management fails because it ignores your energy levels. I learned this the hard way, burning out while trying to be “productive” at all hours.

Matching Tasks to Energy Levels

- High Energy: Complex financial planning, investment research

- Medium Energy: Routine budget updates, bill payments

- Low Energy: Simple filing, email organization

Speaking of energy management, proper rest is crucial. Learn more about optimizing your sleep in our guide on 8 Signs You Need More Sleep and How to Achieve It Cheaply.

The Financial Impact of Energy Management

Poor energy management isn’t just about feeling tired—it’s expensive. Here’s what it might be costing you:

- Productivity losses from working during low-energy periods

- Increased food delivery costs from being too exhausted to cook

- Higher healthcare expenses from stress and burnout

For cost-effective ways to boost your energy naturally, explore our article on 10 Superfoods That Boost Immunity and Are Easy on the Wallet.

Tips for Long-Term Success

- Start small—implement one strategy at a time

- Track your progress using time-tracking apps

- Regularly review and adjust your approach

- Celebrate financial wins, no matter how small

Looking to turn these time management wins into lasting financial independence? Check out 8 Steps to Achieve Financial Independence on a Budget.

Frequently Asked Questions

Q: How much money can good time management really save?

A: While results vary, most people save between $200-$500 monthly through reduced late fees, better purchasing decisions, and improved productivity.

Q: What’s the best time management strategy for beginners?

A: Start with the two-minute rule. It’s simple, requires no special tools, and shows immediate results.

Q: Can time management help with passive income?

A: Absolutely! Better time management frees up hours to develop passive income streams. Learn more in our guide to 15 Passive Income Ideas You Can Start with Little Investment.

Conclusion

Time management isn’t just about squeezing more into your day—it’s about making space for what truly matters, including your financial wellbeing. By implementing these four strategies, you’re not just saving time; you’re investing in a wealthier, more balanced future.

Ready to take control of your time and money? Start with one strategy today. Remember, the best time management system is the one you’ll actually use. Share your favorite time-saving tips in the comments below!