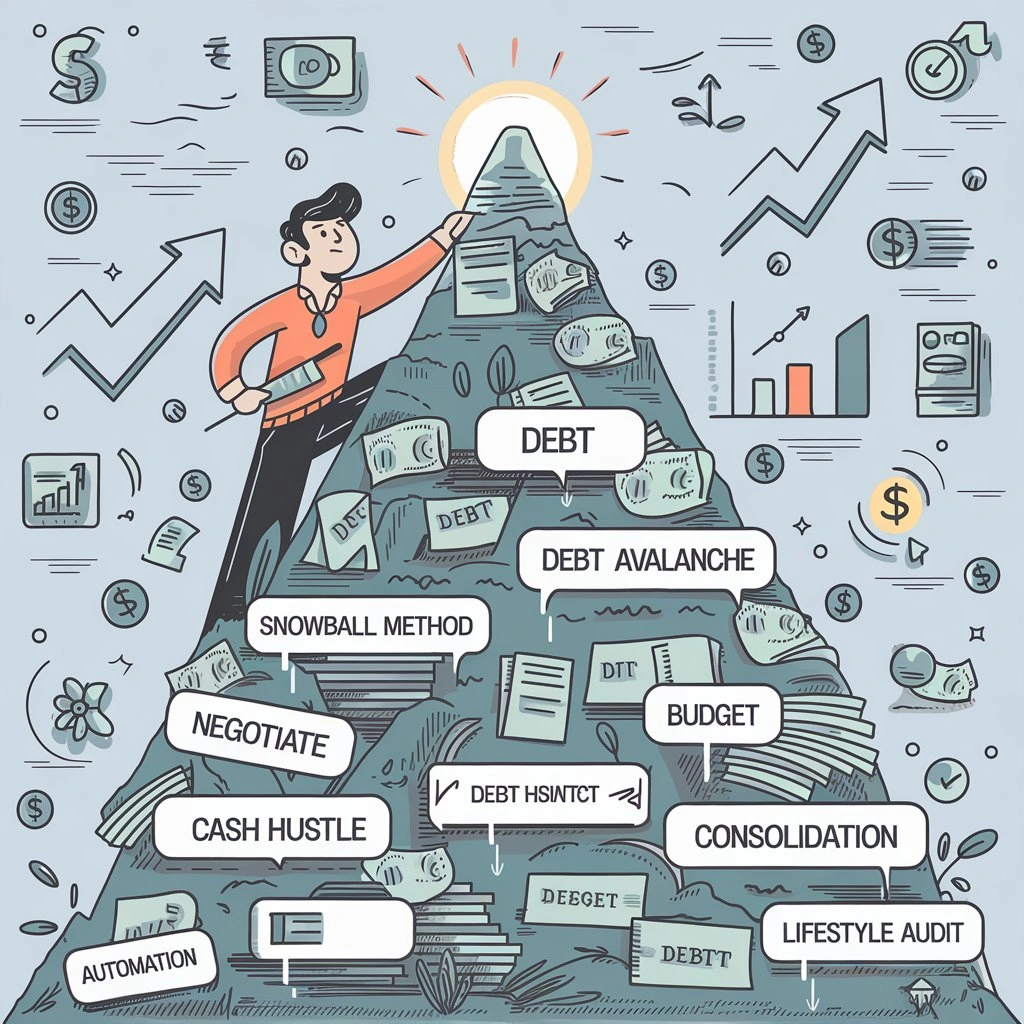

Key Takeaway: Effective debt management doesn’t have to cost extra. With smart strategies and disciplined execution, you can regain control of your finances and become debt-free.

Are you drowning in debt, feeling like you’re barely keeping your head above water? You’re not alone. Millions of people struggle with debt, but here’s the good news: you don’t need to shell out extra cash for fancy programs or quick-fix solutions. I’ve been there, done that, and I’m here to share some real-talk strategies that actually work.

Table of Contents

1. The Debt Snowball Method: Small Wins, Big Results

Ever made a snowman? You start with a tiny ball of snow and roll it around until it’s massive. That’s the debt snowball method in a nutshell.

Here’s how it works:

- List all your debts from smallest to largest.

- Pay the minimum on everything except the smallest debt.

- Throw every extra penny at that smallest debt.

- Once it’s paid off, move to the next smallest.

Why it works: It’s all about psychology, baby. Knocking out those smaller debts gives you quick wins and the motivation to keep going. It’s like leveling up in a video game – addictive and satisfying. For more insights on managing debt, check out 9 Strategies for Effective Debt Management Without Extra Fees.

2. The Debt Avalanche: Crushing High-Interest Debts First

If you’re more of a numbers person, the debt avalanche might be your jam. It’s all about tackling those high-interest debts first.

Steps to avalanche your debt:

- List your debts by interest rate, highest to lowest.

- Pay minimums on everything.

- Put extra money towards the highest interest debt.

- Rinse and repeat.

Why it makes sense: Mathematically, this method saves you the most money in interest over time. It’s like choosing the express lane on the highway – you’ll get to your destination (debt freedom) faster.

3. Negotiate Like a Boss: Lower Interest Rates

Time to channel your inner wheeler-dealer. You’d be surprised how often a simple phone call can lead to lower interest rates.

How to negotiate:

- Know your credit score (it’s your bargaining chip).

- Research competitor offers.

- Call your creditors and ask for a lower rate.

- Be polite but persistent.

Pro tip: If you’ve been a good customer, mention it. Loyalty can pay off. If you want to build your credit score for better negotiation power, read How to Build Credit and Improve Your Credit Score.

4. The Budget Makeover: Finding Hidden Money

Alright, it’s time for some financial soul-searching. A solid budget is your roadmap to debt freedom.

Steps for a budget makeover:

- Track every penny for a month (yes, even that $3 coffee).

- Categorize your spending.

- Identify areas to cut back.

- Redirect savings to debt payments.

Remember: A budget isn’t about restriction; it’s about redirection. You’re not giving up lattes forever; you’re investing in your debt-free future. For tips on budgeting, check out 5 Steps to Creating a Budget That Helps You Save More.

5. Side Hustle Hustle: Boost Your Income

In the immortal words of Destiny’s Child, “I don’t think you can handle this.” But I think you can. It’s time to diversify that income stream.

Side hustle ideas:

- Freelance your skills (writing, design, coding).

- Drive for rideshare services.

- Sell stuff you don’t need online.

- Pet-sit or house-sit.

The key: Every extra dollar you earn goes straight to debt. No exceptions, no excuses. For more ideas, see The Top 5 Side Hustles for Making Extra Money.

6. Debt Consolidation: Simplify and Save

Juggling multiple debts can feel like a circus act. Debt consolidation can be the net that catches you.

How it works:

- Take out a single loan to pay off multiple debts.

- Focus on one payment, often at a lower interest rate.

Caution: Only consider this if you can get a lower interest rate and you’re committed to not racking up new debt.

7. The Cash Diet: Breaking Up with Credit Cards

Credit cards are like that ex you keep going back to – tempting, but ultimately bad for you. It’s time for a breakup.

Steps for a cash diet:

- Cut up your credit cards (or freeze them in a block of ice if you’re not ready for a permanent goodbye).

- Use cash or a debit card for all purchases.

- When the cash is gone, stop spending.

Why it works: It’s harder to overspend when you’re watching real money leave your wallet. Plus, no new debt means you’re not digging the hole deeper. For help with managing expenses, visit How to Save Money on Everyday Expenses.

8. Automate Your Payments: Set It and (Sort of) Forget It

Let’s face it, we’re human. We forget things; we procrastinate. Automation is your new best friend.

How to automate:

- Set up automatic minimum payments for all debts.

- Schedule extra payments to your target debt.

- Align payment dates with your payday.

Pro tip: Always keep a buffer in your account to avoid overdrafts.

9. The Lifestyle Audit: Aligning Spending with Values

Time for some tough love. Are your spending habits aligned with your goal of becoming debt-free?

Steps for a lifestyle audit:

- List your top 5 values.

- Review your spending from the last month.

- Identify misalignments (e.g., valuing health but spending $200 on fast food).

- Make adjustments to align spending with values.

Remember: This isn’t about deprivation. It’s about making conscious choices that support your goals. For more on living a budget-friendly life, check out 10 Affordable Habits for a Healthier Lifestyle on a Budget.

Conclusion: Your Debt-Free Future Starts Now

Becoming debt-free isn’t about quick fixes or magic solutions. It’s about consistent, strategic action. These nine strategies give you a toolbox to tackle your debt without shelling out for expensive programs.

Remember, the journey to debt freedom is a marathon, not a sprint. There will be setbacks and challenges, but keep your eyes on the prize. Imagine the feeling of making that final payment, of seeing a zero balance on all your accounts. That freedom is worth fighting for.

So, which strategy are you going to try first? The snowball method for quick wins? The cash diet to curb overspending? Whatever you choose, commit to it. Your future self will thank you.

Now, go forth and conquer that debt. You’ve got this!